How has EFT-POS and ATM penetration been formed in the last three years in CEE? A recent Printec research in 14 countries of Central and Eastern Europe presents some very interesting facts.

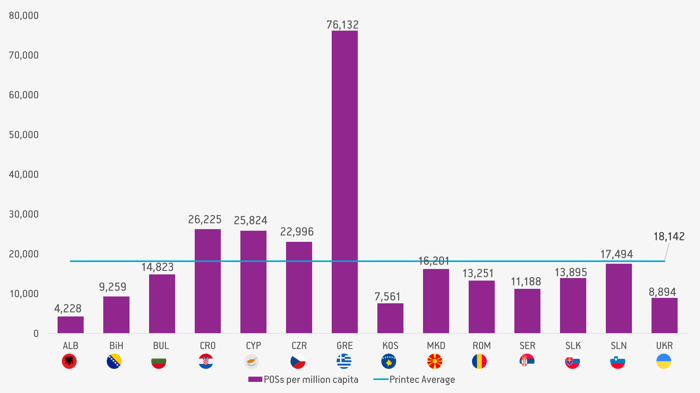

EFT-POSs increased by 20% during 2018-2020

With the increasing popularity of card payments and alternative payments, it is not surprising to see that the number of POS terminals in Printec countries has grown 20% (by approximately 376,000 terminals) from 2018 to 2020. POS penetration has been formed at 18,142 units per million capita in 2020 (from ~14,800 in 2018). For all Printec countries, the total number of POS from 2018 to 2020 has increased with Czech Republic (49%), Albania (40%), Ukraine (31%) and Romania (25%) recording the highest increase. Only in Croatia was there a decrease (-6%) in the total number of POS terminals.

POS penetration in Greece is the highest between the surveyed countries, reaching 76,132 devices per million capita in 2020, while penetration in Albania (4,228 POSs per million capita) and Kosovo (7,561 POSs per million capita) is the lowest.

Paying by card at the point of sale or via alternative channels (online, mobile, etc.) has become increasingly popular and POS terminals have become a commodity in recent years due to their ease of use, the increased usage of electronic payments, improved return on investment, and regulatory framework. In fact, according to the European Central Bank, the total number of non-cash payments in the euro area increased by 3.7% to 101.6 billion in 2020 compared with the previous year, while the number of payment cards issued increased by 6.5% to 609 million cards.

Today, POS functionalities increase and they can do so much more than simply receiving payments; a wide range of applications has been developed around POS terminals including printing bills, inventory management, tipping and cashback and carrying out loyalty programs, allowing business owners to manage front and back-end operations with ease. At the same time, the rising financial frauds across the world have influenced the government regulatory bodies leading to a continuous evolvement of regulatory frameworks to further secure payment transactions, ensuring safe and reliable digital transactions now that more and more transactions are electronic and contactless. Finally, mPOS and SoftPOS expand business flexibility, enabling them to receive payments virtually anywhere with very little equipment required, enhancing customer experience and allowing businesses to be on the move.

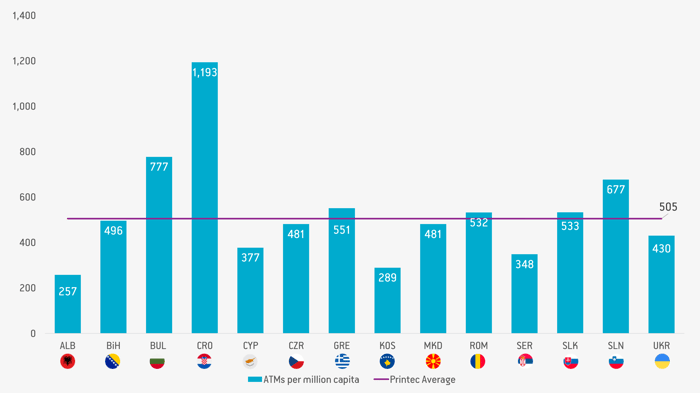

ATM market has been stable during 2018-2020

According to the research, the total number of ATMs installed in Printec countries has remained almost steady at approx. 60,000 units during 2018-2020, marking a drop of -0.4% from 2018 to 2020.

ATM penetration in 2020 is at 505 units per million capita, while per Printec country penetration varies significantly from as low as 257 (Albania) and 289 (Kosovo) to as high as 1,193 (Croatia) and 777 (Bulgaria) per million capita. These differences can be easily explained if we take into account the geographical but also cultural particularities of each country.

Even though the ATM market has been stable in the last 3 years (2018-2020), the ATMs themselves are evolving, mainly in terms of the services they offer, the technologies they use and their design. With customers expecting ATMs to perform like other technologies they are used to, ATM functionality and form have changed towards a more intuitive user experience. From touchscreens, finger pinch zoom, and mobile authentication, banking customers can now enjoy a similar experience at the ATM like on other modern consumer electronic devices.

The role of the ATM in the branch of the future

The COVID-19 crisis has driven digital transformation in 2020, with financial institutions adapting to the new reality. The shutdown of physical stores, social distancing, and lockdowns have pushed both customers and organizations to find new digital ways to transact, bringing everyone up to speed with digital services and self-service channels.

It seems that we will need to get used to having less bank branches in next years and with a different setup. Usually, in bank branches we encounter four service zones – the 24x7 zone (or ATM zone) which is connected to the main branch but physically separated, the assisted self-service zone which is a space inside the branch where people can use devices for a wide variety of transactions but can be assisted by bank staff, if necessary, the consulting zone where real business takes place and the teller zone. In addition to these, we need to take into account the services that used to be performed at the branch, but are now offered remotely, through digital services that financial institutions provide to customers. The branch transformation concept is to move most transactional activities outside of the branch in the 24x7 and the assisted self-service zones (or even to digital channels), while directing prime customers towards the consulting zone, where they will generate more value for the bank.