Before COVID-19, the banking industry did a great deal of talking about ‘becoming digital’, but few organizations considered themselves digital transformation leaders.

Everything changed overnight when the coronavirus pandemic hit.

Organizations were forced into providing consumers with digital banking alternatives and equipping their employees with the necessary tools to ensure they're able to work efficiently; moving online everything that could be moved online was the only way forward. For those who were not prepared, customer satisfaction was jeopardized, business opportunities were lost and employees were unable to do their job.

Becoming digital in the blink of an eye

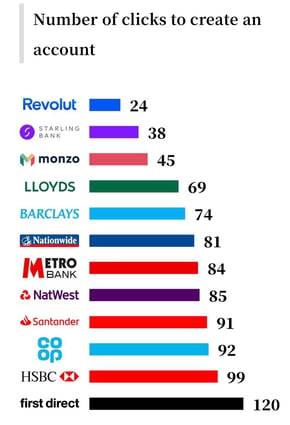

A few weeks ago, a LinkedIn post by Chad West, the Director of Marketing and Communications at Revolut went viral, presenting the number of clicks needed to create an account, an experiment carried out by Built for Mars.

In an industry where customer's effort is measured by the number of clicks, is digital really an option?

Undoubtedly, COVID-19 has forced financial institutions to face and recognize the value of digital transformation and make it the number one priority. The shift to digital has led banks to accelerate digital sales programs and experiment with pure digital processes within acceptable risk limits. Solutions like eSignature and digital onboarding have become very popular as they enable customers to perform services at their convenience, avoiding branch visits. At the same time, the use of e-banking and m-banking services spiked during the lockdown, while many banks revamped their digital channels, adding new services to better serve their customers' needs.

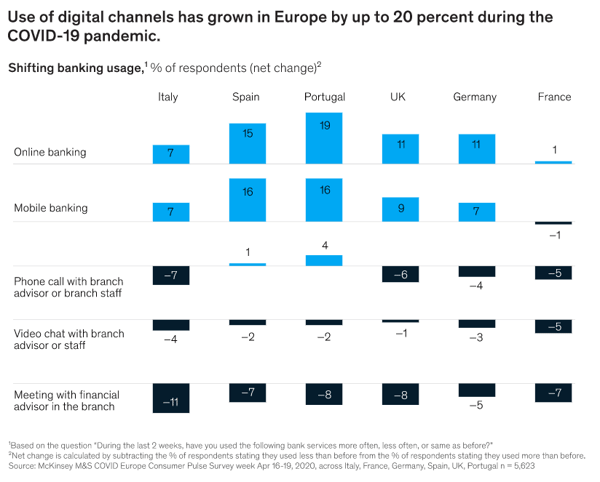

According to a survey by McKinsey & Company, in just a couple of months, customers’ adoption of digital banking has leapt forward by a couple of years, showing 10 to 20 percent rise in digital banking use across Europe in April. Such a jump in adoption opens the door for banks to turn digital channels into real sales channels, not just convenient self-service tools, as mentioned before.

Source: McKinsey & Company - No going back: New imperatives for European banking

Digital transformation is not only about customers; financial institutions need to restructure tech and improve agility in the core. The discussion about working from home for most banking employees was just that – a discussion. When COVID-19 hit, working from home became the norm for almost everyone; new equipment was purchased, new working environments were created, company policies changed and new work schedules were set to balance work and family needs.

As we look to the future, organizations need to reimagine their work and the role of offices in creating safe, productive, and enjoyable jobs and lives for employees. Some workers will return to the traditional office when the coronavirus crisis subsides, but many others will continue working remotely. The question is, what role should offices play and will there be a need to build 50-story bank headquarters in the future?

Educating customers in the 'new normal'

Lockdown, social distancing and other pandemic-mitigation measures boosted the need for digital banking services, forcing everyone to learn the digital way. It might sound obvious for the vast majority, but many groups, like the elderly, were intimidated by technology and had never used apps or online banking before.

The past few months have been a fast track learning period when it comes to technology and lockdowns have served as a jolt to the trial and adoption rate of digital banking services. Banks had - and still have - the opportunity to educate and support customers who have the capability to interact remotely and bring them up to speed. To scale up this interaction, among others, banks need to train their staff and consider adding inline assistance to apps and online banking to help customers leverage all features of digital services.

This transformational impact and learnings will remain with us even after the crisis; a high percentage of new digital banking users are expected to continue to use digital channels, embracing technology and becoming digitally literate.

Accelerating branch makeovers

Could the coronavirus create a shift in behavior, as people are forced to bank online or on their mobile devices? If you can do everything, from paying utility bills to opening a new bank account or receiving a loan from the convenience of your couch, why would anyone go back to the bank branch?

Overall branch transformation efforts will be accelerated through new concepts, further footprint consolidation, more standalone ATMs and self-service kiosks with additional servicing capabilities. Branches are moving away from full-service spaces and towards specialized advice centers - a thoughtful consolidation of bank branches wouldn't be surprising in the post-pandemic era.

Visit our Branch of the Future and discover how to transform a branch into an open and engaging customer experience while reducing costs; explore the possibilities and the solutions we provide.

Eventually, the coronavirus pandemic will subside, but the overall impact of COVID-19 won’t be known for months - if not years. Nobody knows what the world will look like as we have seen that change can happen in an instant. The global economy may look very different when we get back to ‘normal’, but there one thing that is certain: being ‘digital’ is not an option anymore; it is imperative.