Biometrics in the financial and payments industry are usually used for the recognition and authentication of individuals, based on physical or behavioral characteristics. These characteristics are unique from one person to another, easy to be recorded and measured (although the processes of capturing, storing and transmitting such data is a longer and more complicated discussion).

Over 75% of consumers worldwide are already using a form of biometric technology, either on their smartphones and tablets or by using a digital signature. It is estimated that all smartphones built and shipped in 2019 will contain biometric technology.

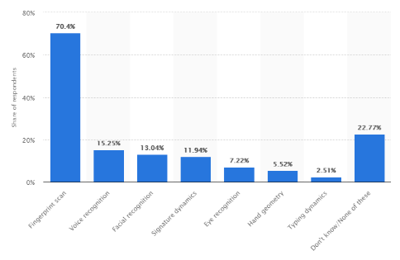

In the United States, in 2018, 70.4% of used biometrics were fingerprint scan technology and only 2.51% of consumers used typing dynamics.

The evolution of biometrics has helped ease the authentication in server rooms, data storing buildings, IT infrastructure departments or in places with high security. Today it is also available for more common transactions such as unlocking devices (smartphones f.e.), authenticating a user of an application and confirming receipt of products or services.

What are the most popular types of biometrics?

Vein recognition

The different types of vein recognition available are eye, finger and palm vein recognition. The patterns of blood vessels can be used for personal recognition which is unique for each individual. Iris recognition can be done from a distance, while retina identification requires more proximity.

Eye vein patterns don’t change with age and the identification can be made through glasses or contact lenses.

Finger vein patterns are harder to replicate because they are hidden deeper in the skin, and they are more secure than fingerprint scanning.

Palm vein recognition is a biometric authentication method based on the unique patterns of veins in the palms of people's hands.

Voice recognition

This technology is the cheapest recognition method of all biometric systems. The voice can be used to access financial data, to playback information, and to direct calls to specific departments. The unique tone of voice can be a solution instead of passwords or pins, and provides easy access and security.

Facial recognition

High-quality cameras are able to identify a profile nowadays from a bigger distance. A face recognition setup requires only a performant camera and dedicated software. It is a common biometric technology and due to its popularity could become more rapidly vulnerable to cyber attacks.

Biometrics in banking

Banks and financial institutions started using biometrics to safely authenticate their customers. Besides vein, facial and voice recognition there are other irregular patterns used in the banking sector as gait recognition, DNA sequences, fingerprints, or typing patterns and rhythms.

The biometric system used depends on the service that needs to be secured. For example, fingerprint recognition is the one most widely used for mobile banking. Iris recognition is used by banks for app login and is expected to see a double growth in the next 5 years. Face ID service by Apple provides facial recognition services for iPhone users to sign in their banking apps.

The adoption of biometrics in banking is a great option to prevent financial fraud, cyber attacks and identity theft. Bank customers are using technology to access their banking services, and prefer less interaction with banks and easy access to all applications. Customers also prefer biometrics as a form of identification and authentication since it provides faster and easier access to apps and services.

The Goode Intelligence research states that by the end of 2020, 1.9 billion bank customers will access financial services with the help of biometrics. ATM cash withdrawals, home banking, digital bank services, IoT devices and mobile apps will require a form of personal recognition.

Ultimately it will be on the omni-channel strategy of each bank to decide which customers will be able to use which kind of private recognition, and when.

Printec has already created and installed in-branch self-service kiosks that use palm vein recognition for authentication and for the execution of a pre-decided transaction that differentiates the bank from its competitors and offers fast and secure access to their services.

Contact us if you want to find out more.