In a dynamic and challenging economic landscape, banks were somehow forced to re-adapt and embrace digital transformation. The key reasons for doing that....

- Customers’ needs are changing and are more about the access to remote services provided by user-friendly & digital features;

- Digital transformation is a must have for each bank in order to survive competition;

- Investments in digital services could be the best choice for long-term savings (fewer branches/ fewer employees, for example);

- To be a leader in banking market means, first of all, to be customer-centric and tech savvy.

Is banking industry affected by this digital disruption? And, if it does, how great the impact is? Those are the main 2 questions which we had in mind when we’ve started our study The state of Bank Branches & ATMs.

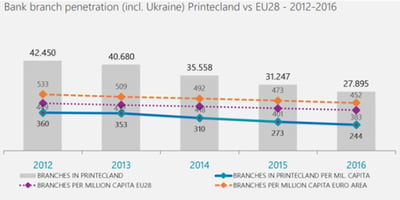

" From 2012 until 2016 we saw a radical reduction in bank branches per capita, mainly led by the need for bank organizations to reduce costs - during this period more than 31,000 branches were closed."

In the past 6 years, banks were strategically reducing their branches in an effort to control and reduce capital and operational expenses associated with those branches.

In the past 6 years, banks were strategically reducing their branches in an effort to control and reduce capital and operational expenses associated with those branches.

New technologies and customer behavior shifts (especially those belonging to Generation Y & Z) provide banks with additional channels that help them successfully apply their strategies while maintaining a great user experience and in many cases offering additional services to their customers.

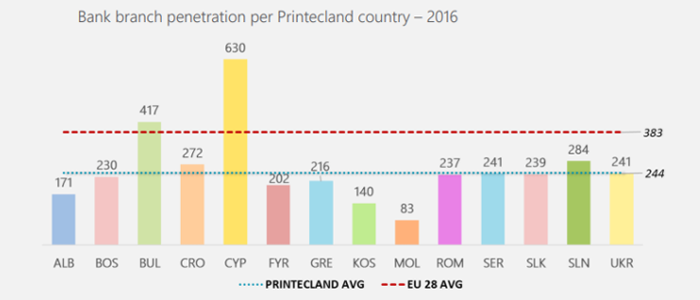

The penetration rates per country vary significantly from as low as 83 (Moldavia) to as high as 630 (Cyprus) per million capita. Almost all Printec countries followed the same trend of shrinkage in terms of penetration. The only exception was Slovakia which showed a week increase of +1%.

We’ve also done a similar analysis for ATMs to helps us understand how banks decided to respond to nowadays challenges from this point of view. In order to maintain their level of service to high standards and not to lose customers to competition (or fintech organizations that started appearing within the last few years) banks kept their ATM fleets stable, making sure that customers could perform a number of transactions through ATMs instore as well as off-site (e.g. in malls, super-markets, etc).

- Do you want to access more research data about how bank’s branch and ATMs have been developed in numbers in EU28 and CEE?