It’s already a fact that banks become every year more digital - and the process seems to continue. Once with this transformation plenty of questions and debates came:

- Are banks’ branches and ATMs becoming irrelevant?

- Will banks close the majority of branches in order to create space for even more digital services?

- So customers still need human interaction?

In order to have a clear image of the banking transformation over the past years, we’ve developed a study based on pre-existing reports (2012 - 2016) and trends evaluation by Printec’s consultants: The state of Bank Branches & ATMs.

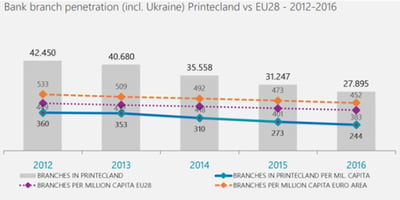

The results of this study prove that since 2012 bank branch penetration (branches per million capita) has been declining yearly. For example, in Printec region from 360 branches per million capita in 2012, penetration fell to 224 in 2016. (access more info about banks’ penetration from here)

In meanwhile, from ATMs fleet’s perspective banks haven’t done major changes. The fact that ATMs offered 24/7 availability of transactional services across multiple locations (in branch and offsite) defined the very landscape of ATM market. Recent technological advancements that enable financial transactions to be conducted over wireless devices such as mobile phones and smartwatches are boosting the growth of the world ATM market. But this is just a general conclusion.

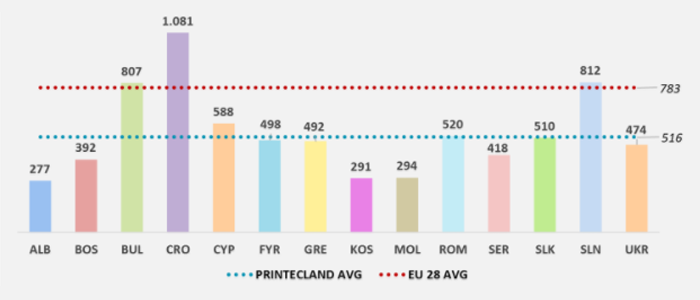

For Printecland we’ve observed specific trends taking into account that each country had its own path. For example, ATM penetration 2016 per Printecland country varies significantly from as low as 277 (Albania) to as high as 1,081 (Croatia) per million capita. ( see more research data )

Starting from this obvious trends our very next question was: how banking market will look like in the future? No more branches? Fewer and fewer ATMs?

Take a look at our predictions:

- Banks still need a place where they can maintain human interaction, have meaningful conversations with their customers, aiming to sell more complex or more added-value products and services. This is leading to an increase of smart branches that occupy less space, less staff, but bring in more revenue for the bank;

- Within the next 4-5 years, integration with mobile and other external services as well as branch transformation (followed by availability of new functionalities) are expected to be the most important factors that will influence the ATM networks in Europe.

Do you want to access more research data about how bank’s branch and ATMs have been developed in numbers in EU28 and CEE?