Our mission is to provide our customers with access to innovation and lead them step-by-step to improved services and more profitable investments. That is why conferences with digital transformation as a theme are of interest to us.

We were recently invited at SmartCard, an international conference hosted in Croatia, where we discussed the changing environment of the financial industry and how banks should respond in order to remain relevant in the market and grow their profitability.

Below you can see:

- What new did SmartCard bring this year to the financial sector?

- Printec’s point of view over the agents that are driving change both in the consumer’s behavior but also in the business and financial space

- How banks can redesign their profitability through digital services - a case study for Raiffeisen Bank Serbia

Get ready for the digital transformation and discover now what solutions best suit your business: Schedule a Free Assessment with our Consultants

What was SmartCard Conference agenda for this year?

This year the conference brought together traditionally the most important world producers of software and solutions, including domestic providers, banks and other institutions.

These are a few of the topics that were covered during the conference:

- New versions of cards, standards, technologies, and infrastructure

- The use of smart cards in banking and other areas

- NFC, using a mobile phone for payment (mPayment), using tablets and other devices

- Nocard applications

- ATMs, kiosks, branch automation

- Solutions and security operations with smart cards

The event ’s agenda was rich and the presentations full of data, insights, and inspiration on what is to come.

The topics presented ranged from artificial intelligence, digital and omnichannel payments, the future of bank branches and the power of customer experience.

Printec presented the agents that are driving change both in consumer’s behavior but also in the business and financial space.

Based on these changes, we also showed how the evolution of bank branches and ATMs has been in the region of Central and Eastern Europe, how it compares with the European Union, and presented a few examples of new bank branch design from different banks around the globe.

In short, the reasons why we have seen such massive changes in the business landscape could be summarized into:

- The demographic shift where younger people are becoming a dominant force both as workforce but also as consumers,

- The technology introduction where people are connected and perform most transactions through smartphones, tablets, and laptops,

- The merge of physical with digital in commerce, where customer journeys blend both experiences for each purchase,

- The existence of data for a great number of steps and transactions towards a purchase; a valuable tool for any business to use.

These changes have also resulted in the disruption of the financial sector, with banks being more affected than most financial organizations. The main drivers for the banking sector change are:

- The fact that fintech companies have emerged and are taking big parts of the business that was traditionally banking,

- The introduction of biometrics that creates a competitive advantage and resonates mostly with the younger segments of the population,

- The potential of mobile and electronic payments that are changing the way people consume products and services,

- The legal framework that is catching up with technological advancements and allows for the use of technology in more sensitive areas such as payments and authentication.

Some stats & numbers about how banks have responded to the changing environment

Research shows that in Central and Eastern Europe bank branches have been decreasing in number in double pace than the EU, while ATMs have remained relatively steady. What this shows is that banks are trying to reduce their costs by minimizing their retail presence, but at the same time need to be able to service their customers with more points (through ATMs).

But some banks are going even further than this; they have decided to make better use of their remaining branches, and have redesigned them in order to make the most out of this channel.

What most flagship branches focus on is to accommodate more self-service functionalities, increase the value-added transactions in the branch, and empower people to do more business through specially designed spaces, co-working zones, meeting rooms and café areas inside the branch.

Take a look at the following case study to discover how Raiffeisen Bank Serbia made from “bank yourself” the smartest digital investment in branch transformation.

Raiffeisen Bank Case Study: How can a bank redesign its profitability through digital services

Market trends and challenges:

Market trends and challenges:

Traditional ATMs are no longer popular. Customers overcame the lack of trust in safety and security and are more interested and time-efficient services.

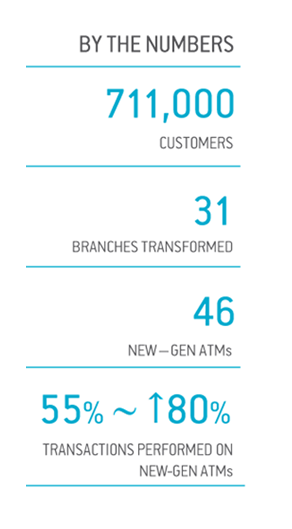

Successful digital transformation story: Raiffeisen Bank Serbia - ATMs banking with human touch

Bank’s challenge: improve customer experience through extending its branch network, available services as well as longer working hours, but at the same time minimize operational costs.

The solution: Introduces a “bank yourself” concept where each customer would have personalized functionalities while making consultants available for more complex customer requirements.

The results:

- Unique customer experience;

- Branch productivity;

- Profit optimization.

"With this solution, we managed to make the most of technology, while at the same time maintaining and even strengthening our direct communication with the customer for the things that matter most for them." (Raiffeisen Bank Serbia)

Do you want to start designing a successful story for your banking company?

Schedule 30 minutes to talk about your main challenge with one of our consultants, and we'll help you identify quick wins that you can implement starting today.