The clock is ticking – support for the Microsoft Windows 7 operating system is long gone and financial institutions must prepare themselves. On January 14, 2020 Microsoft ceased to provide security updates, application patches and technical support for ATM deployers running Windows 7. As a result, Windows 7-based ATMs are at risk of not being PCI DSS (Payment Card Industry Data Security Standard) compliant and banks could face financial penalties.

Once again, the global ATM industry is at an inflection point. Of the roughly 3.4 million ATMs in operation today, Windows 7 OS represents 75% of the global ATM network, a percentage that cannot be overlooked. Unlike the shift from Windows XP to Windows 7, the move to Windows 10 is totally different. This time it’s not just about software that optimizes the machines; it’s about optimizing the experience of customers and financial institutions should amend migration strategies and budgets to accommodate Windows 10.

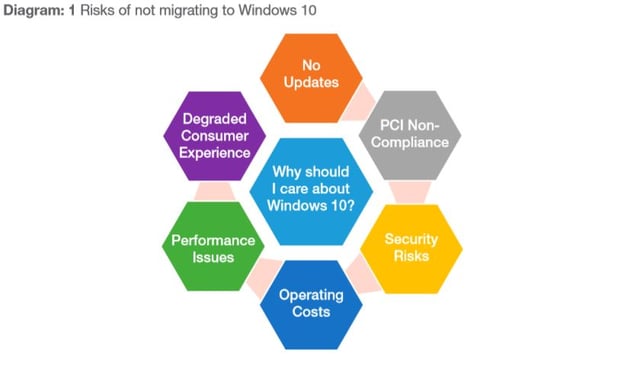

What if you don't move to Windows 10?

In recent years, ATM fraud has risen, up 10 percent in the number of payment cards compromised at U.S. ATMs and merchants in 2017, according to FICO.

With a growing threat of malware and cyberattacks, no financial institution can afford to do without the necessary security updates which are vital to secure ATM operations. Once Microsoft stopped supporting Windows 7, your fleet is at risk from attackers, who could take advantage of known vulnerabilities similar to the WannaCry attacks which took place in mid-2017.

source: https://www.atmmarketplace.com/whitepapers/windows-10-be-ready-be-secure-be-compliant/

Criminals are evolving as fast as the technology that powers ATMs, and financial institutions must constantly refine their defense strategies to avoid vulnerabilities. Outdated systems are often convenient targets and any machines still running Windows XP, or Windows 7 after January 2020, won’t have the necessary patches and security updates to counter sophisticated attacks. So, as hackers look for victims, security risks rise and added costs appear, as operating an unsupported OS is expensive.

Of course, as you can imagine, ATM jackpotting attacks make the headlines and no financial institution is willing to jeopardize its credibility. Protecting your brand and maintaining customer’s confidence in your organization is and has always been a priority. Windows 10 migration will futureproof your business and mitigate reputational risk by ensuring optimal operation of the ATMs, through advanced functionality, speed and reliability.

Windows 10 is much more than a new OS

Windows 10 is not simply a technical migration; in fact, it is an opportunity to further enable financial institutions to enhance security and bring the omni-channel world to life.

Microsoft’s latest operating system comes with additional functionalities and improved security. Among the advanced features available, Device Guard is one of the most anticipated. Operating alongside Windows 10 as a mini-operating system, this new security feature blocks malicious software giving ATMs an extra level of protection.

Migrating to Windows 10 enables financial institutions to modernize their ATMs and to support branch transformation solutions, improving the user experience. The integration of technologies such as Internet of Things (IoT) smart sensors, biometrics, and contactless/mobile payments technologies into the ATM fleet allows users to seamlessly connect and interact with the machine, while financial institutions will be able to easily push out targeted marketing messages to ATM users, offering more personalized experiences.

Time's almost up. Make sure your strategy is in place.

It might seem obvious, but the best approach for one bank may be completely unsuitable for another. There are best practices for migrating to Windows 10, for sure, but there is no one-size-fits-all solution. Each organization is different and has different challenges to tackle to make the upgrade to the new OS as smooth as possible.

As part of your Windows 10 planning process, it is key that you have an accurate and current view of your ATM fleet, with detailed insight into each ATM in the network. Associated strategies of branch modernization, digitization of channels, scope and role of consumer experience plans, consumer marketing and brand positioning are some other factors that should be taken into account when drafting your migration strategy.

If you’re evaluating a hardware first approach, make sure your ATM network hardware is 100% Windows 10 ready. Otherwise, if you upgrade both ATM hardware (if required) and software, you can minimize potential impact to your ATM network and provide your team with more flexibility to introduce further migration projects as part of the journey to enhancing consumer experience.

Whether you choose to deal with hardware first and proceed to software migration, or you prefer a more aggressive approach of hardware and software together, it’s essential that you develop your planning process and migration strategy with your vendor partner to assess lead times, input to enhance your migration approach and share best practices.